ADLER REALTY PORTFOLIO

Our Portfolio

Adler Realty's portfolio has over $1 billion worth of properties acquired or in development, and currently consists of over 4 million square feet of industrial, office, retail, and multi-family residential properties.

BROWSE THE ADLER INDUSTRIAL PORTFOLIO

2200 Bristol Road | Bensalem, PA

- Current Holdings

62,880 SF Retail Shopping Center

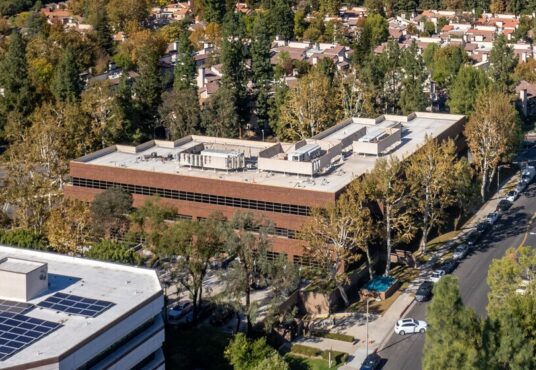

Warner Center Business Park | Woodland Hills, CA

- Current Holdings

20920-21051 Warner Center Lane, 20931, 20951 & 21041 Burbank Blvd, Woodland Hills, CA WARNER CENTER CORPORATE PARK consists of 346,302 SF on 24.41 acres and was built from 1982-1984. This park is located 1/2 half miles north of the 101 freeway on DeSoto Ave. It offers a campus environment with lush landscaping and an abundance […]

651 E. Gowen Rd., | Boise, ID

- Current Holdings

165,000 SF of Industrial Warehouse

6801-6841 NE Columbia Blvd.| Portland, OR

- Current Holdings

135,734 SF Industrial Park in Portland, OR.

16280 Norco Way | Nampa, ID

- Current Holdings

90,000 SF multi-tenant industrial building in Nampa, Idaho

16140 Norco Way | Nampa, ID

- Current Holdings

90,000 SF multi-tenant industrial building in Nampa, Idaho

16240 Norco Way | Nampa, ID

- Current Holdings

90,000 SF Multi-Tenant Industrial Building in Nampa, Idaho

1717 E. Fargo Ave. | Nampa, ID

- Current Holdings

49,000 SF Industrial Building in Nampa, Idaho.

1493–1505 S. Randall Rd | Algonquin, IL

- Current Holdings

13,807 Sf Retail Shopping Center in Algonquin, Illinois.

5825 NE Skyport Way | Portland, OR

- Current Holdings

77,960 SF industrial building in Portland, OR.

240 W. Taylor Ave. | Meridian, ID

- Current Holdings

184,417 SF Industrial Facility in Meridian, Idaho.

20944 Vanowen Street | Canoga Park, CA

- Current Holdings

70,958 Square Foot Apartment Complex Development in Canoga Park

1500 W. McGalliard Rd. | Muncie, IN

- Current Holdings

An 81,061 SF Retail Shopping Center in Muncie, Indiana.

5415 S Santa Fe Ave | Vernon, CA

- Current Holdings

3 industrial buildings totaling 63,756 Sf on four separate land parcels totaling 3.87 Acres in Vernon, California.

23901 Calabasas Rd. | Calabasas, CA

- Current Holdings

99.896 SF Office Building in Calabasas, California.

211-251 North Main Street | Sikeston, MO

- Current Holdings

A 30,300 SF neighborhood retail shopping center located in Sikeston, Missouri.

5145-5147 Bayou Boulevard | Pensacola, FL

- Current Holdings

5563 DeZavala Road | San Antonio, TX

- Current Holdings

University Heights Business Park

21800 W. Burbank Blvd. | Woodland Hills, CA

- Previous Holdings

A 3-story 66,372 SF office building located at 21800 Burbank Blvd. in Woodland Hills, California.

1733 and 1833 Alton Parkway | Irvine, CA

- Previous Holdings

An 80,088 SF building at 1733 Alton Parkway and a 129,263 SF building at 1833 Alton Parkway in Irvine, California.

18551 Von Karman Ave. | Irvine, CA

- Previous Holdings

A 74,098 SF two-story office building located at 18551 Von Karman Ave. in Irvine, California.

851 N. Harvard Ave. | Lindsay, CA

- Previous Holdings

A 132,000 SF manufacturing and distribution facility located in Lindsay, CA.

750 Terrado Plaza | Covina, CA

- Previous Holdings

A 60,006 SF office building complex located at 750 Terrado Plaza in Covina, CA.

955 Overland Court | San Dimas, CA

- Previous Holdings

An 86,300 SF Office Building in San Dimas, CA

2972 Stender Way and 2901-3001 Coronado Drive | Santa Clara, CA

- Previous Holdings

227,600 SF multi-tenant office R and D buildings in Santa Clara, CA.

28941 and 29105-29145 Canwood Street | Agoura Hills, CA

- Previous Holdings

A 36,214 SF 5-building retail center in Agoura Hills, California.

4345 W. Fairfield Drive and 44880-4500 Mobile Hwy | Pensacola, FL

- Previous Holdings

A retail shopping strip center, a restaurant, and a vacant lot in Pensacola, Florida.

6100-6200 Tennyson Parkway | Plano, TX

- Previous Holdings

250,448 SF Office Building Complex in Plano, Texas

1450-1460 N. Lake Avenue | Pasadena, CA

- Previous Holdings

A 26,541 two-story office building located at 1450-1460 North Lake Avenue in Pasadena, California.

Soledad Circle Estates | Santa Clarita, CA

- Previous Holdings

19.5 acres of vacant land for residential development in Santa Clarita, California.

Fairway Business Park | Lake Elsinore, CA

- Previous Holdings

295,000 SF of Industrial Buildings in Lake Elsinore, CA

Chatsworth Industrial Park | Chatsworth, CA

- Previous Holdings

152,970 SF of Industrial Buildings In Chatsworth, CA

2361 Nalin Drive | Bel Air, CA

- Previous Holdings

A residential home development in Bel Air, California.

2121 & 2151 S. Haven Ave. | Ontario, CA

- Previous Holdings

Two office buildings totaling 26,432 SF at 2121 and 2151 S. Haven Avenue in Ontario, California.

8591-8599 Prairie Trail Drive | Englewood, CO

- Previous Holdings

83,302 SF of office/industrial space in Englewood, Colorado.

100 W. Broadway | Long Beach, CA

- Previous Holdings

A two-tower, 6-story office complex measuring 209,882 SF located in Downtown Long Beach, California.

4002-4006 Belt Line Road | Addison, TX

- Previous Holdings

A 205,771 SF office and retail/restaurant space located Addison, Texas.

1901-2401 E. Brundage Ln and 6881-6901 District Blvd. | Bakersfield, CA

- Previous Holdings

Six Industrial Buildings totaling 526,350 SF in Bakersfield, California

.

11882-11910 Greenville Ave | Dallas, TX

- Previous Holdings

173,790 SF five-building office complex on 10.01 acres in Dallas, Texas.

324 Inverness Drive South | Englewood, CO

- Previous Holdings

9.38 Acres of Vacant Land at 324 Inverness Drive South, Englewood, Colorado

Mission Trail | Lake Elsinore, CA

- Previous Holdings

Adler Realty Investments acquired the Mission Trail Residential Project in 2005 and sold it, undeveloped, after 13 years through a 1031 exchange. This residential project consisted of 19.5-acres of residentially zoned property in Lake Elsinore, California. The project site was bordered by vacant land to the north and south, by the current Lake Elsinore Motocross […]

249 E. Ocean Boulevard | Long Beach, CA

- Previous Holdings

A 112,215 SF Office Complex located on 249 East Ocean Blvd. in Long Beach, CA.

11735-41 Sheldon St. | Sun Valley, CA

- Previous Holdings

This property consist of a rectangular shaped lot of 1.19 acres. The site is improved with a two 1- story industrial buildings that were constructed in 1972. The improvements contain 27,941 sf of building area. Theere is a total of 4008 square feet of office built out and there are apprxo 35 open, on-site parking […]

500 Fountain Lakes Blvd. | St. Charles, MO

- Previous Holdings

This is a 53,932 SF single-story, multi-tenant office building on 5.74 acres of land in St. Charles, Missouri. The property was built in 2001 and offers a great location and accessibility near Highway 370 and New Town Boulevard/Elm Street. St. Charles is one of the largest cities in the St. Louis metropolitan area, offering superior […]

1925-2095 W. Pinnacle Peak Rd. | Phoenix, AZ

- Previous Holdings

A 164,399 SF office complex located at 1925, 2001, 2075, and 2095 West Pinnacle Peak Road in Phoenix, Arizona

2600 N. Central Ave. | Phoenix, AZ

- Previous Holdings

2600 Tower is a 323,067 SF office building located on 2.74 acres in Phoenix, Arizona.

4900 California Ave. | Bakersfield, CA

- Previous Holdings

etails Date Purchased:August, 2005 Sale Date: January, 2020 Holding Period: 180 months Completed Business Plan Acquired 4900 California Avenue in 2005. Executed multiple leases to stabilize the property. Sold the project and executed a 1031 exchange.

1965 & 1917 W. First St. | Tempe, AZ

- Previous Holdings

A 33,400 SF industrial building located in Tempe, Arizona.

1401 S. Siesta Lane | Tempe, AZ

- Previous Holdings

25,570 SF Industrial Building in Tempe, Arizona.

21605 N. Central Ave. | Phoenix, AZ

- Previous Holdings

50,937 SF Industrial Building in Phoenix, Arizona

28501-28505 Canwood Street | Agoura Hills, CA

- Previous Holdings

A 118,000 SF Retail Shopping Center in Agoura Hill, CA

13294 Ralston Ave. | Sylmar, CA

- Previous Holdings

An 18,700 SF bakery/food production facility located in Sylmar, CA.

16964 S Highland Ave | Fontana, CA

- Previous Holdings

A 78,000 SF Retail Shopping Center in Fontana, CA.

30601 Agoura Road | Agoura Hills, CA

- Previous Holdings

A 117,34 SF, two-story, multi-tenant office building on 6.57 acres of freeway frontage land in Agoura Hills, CA.

2725 Hamilton Mill Road | Buford, GA

- Previous Holdings

48,470 SF retail shopping center located at 2725 Hamilton Mill Road in Buford, Georgia.

225 W. Hillcrest Dr. | Thousand Oaks, CA

- Previous Holdings

A 157,000 SF Office Building in Thousand Oaks, California.

3151 Cahguenga Blvd. | Universal City, CA

- Previous Holdings

This 3-story property comprises a 35,310 SF office building located at 3151 Cahuenga Blvd. in Universal City, California.

4130 Cahuenga Blvd. | Toluca Lake, CA

- Previous Holdings

Universal Court is a 72,283 SF office building in Toluca Lake, California.

761 Corporate Center Dr. | Pomona, CA

- Previous Holdings

761 Corporate Center Drive is a 62,036 SF office building in Pomona, CA

15023 Dickens St. | Sherman Oaks, CA

- Previous Holdings

13-Unit apartment building in Sherman Oaks, California.

FEATURED PROPERTIES

Current Holdings

INVESTMENT STRATEGIES

Adler implements several strategies when targeting investments in order to achieve above market returns.

Development

Raw land or under-utilized locations with existing structures offers numerous opportunities at various stages of development. Property may be sold with designs, upon entitlement approval, completion of construction or after the pre-lease of a majority of the space. Permanent financing may be secured upon completion and stabilization and all or part of initial investor equity may be returned and the project held for cash flow.

Stabilized Value-Added Properties

May be acquired with high occupancy established, but at rental rates that are below market. Existing tenants’ rental rates are increased as they expire, which increases the asset value, which promotes further rate and value increases and the ultimate sale of the property at a significant profit, typically over a period of three to seven years.

Value-Added Properties

May be acquired with high occupancy established, but at rental rates that are below market. Existing tenants’ rental rates are increased as they expire, which increases the asset value, which promotes further rate and value increases and the ultimate sale of the property at a significant profit, typically over a period of three to seven years.

Under-Valued Properties

Offer the potential for substantial short-term profit or extended above-market returns. The approach utilized is based upon an evaluation of the specific facts and circumstances of each such opportunity, and the associated holding period will vary accordingly.

Cash-Flow Properties

Are high-quality, fully occupied properties in prime locations that have significant profit potential due to rent escalation provisions or other unique physical or location characteristics. This type of property offers excellent cash flow for a typical five to ten year holding period.